Planning is everything in business, but you can’t plan for everything. So, we negotiate. Join Christine McKay as she sits down with Founder and President of Cambridge Argillite, LV Randolph, to discuss how to navigate the negotiation table, so you don’t flush money down the drain. In today’s episode, we talk about critical factors to consider when negotiating with buyers. We cover everything from understanding your business valuation to learning marketplace trends. LV also talks about the importance of knowing when to call in the cavalry and get help with your business so you can move to the next level.

—

Watch the episode here

Listen to the podcast here

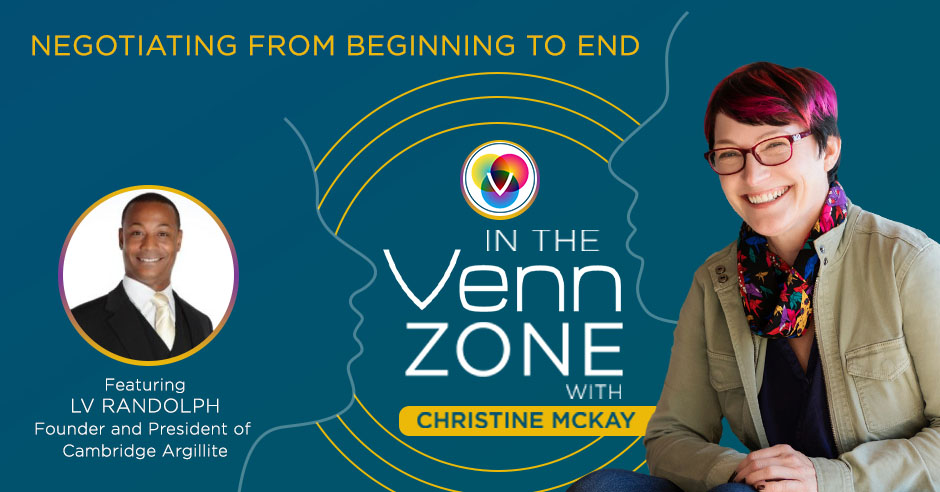

Negotiating from Beginning to End with LV Randolph

I am super excited. I’m always super excited because that’s who I am. I am honored and it’s awesome to have with me LV Randolph. I’m excited about having him on the show and you will quickly find out why. LV is using his twenty-plus years of experience and skillset for innovation and starting companies to help guide other entrepreneurs. He is passionate about identifying business opportunities, and his lifelong mission of doing well while doing good espouses his commitment to the Conscious Capitalist Movement.

In 2018, Cambridge Argillite’s business development division merged to form the Roxbury Business Development Group. RBDG is committed to providing practical and impactful business solutions for early stage entrepreneurs and small businesses of color looking to start and scale their operations, to provide clients with expert assistance while funding their capital requirements and providing resources vital to their growth and sustainability. LV has been involved in a lot of different projects from RentCambridge.com, Pale Real Estate, Grey Management, Trans Metro Media, which there’s an interesting story there, StartupLab Allston. He joined the team of Tintagel. LV, I am excited to have you. Thank you for being here with us. This is great. It’s great to see you.

Thank you, Christine. It’s an honor for me. I enjoyed our initial conversation. It was very enlightening and insightful. I learned a lot from you during that conversation and I look forward to this conversation.

I read your bio and they’re not fully descriptive. Tell us how you got to where you’re at now. Tell us more about what you do. Fill in the blanks for the audience.

I would describe myself as an entrepreneur. I started my first company when I was in college. I failed the plan one year. I was supposed to go out and get a job for the summer. I was too busy hanging out with my girlfriend at the time, and I didn’t do what I was supposed to do. I ended in Harvard Square. I was walking past this little basement office, and they had a help wanted sign in the window. Do you remember when people used to do that? They would put a sign in the window. I saw the sign. I said, “I’m just going to go for it.” I was very afraid of having to tell my parents that I didn’t do what I was supposed to do. I went in. I met with a gentleman. I convinced him to give me a job.

I turned out this was a real estate office. It was called Channing Real Estate. Bill and Catherine are the owners of that company. They’ve been in business for a number of years. I found it and said, “I’d like a job.” I convinced Bill to give me a job. That was a pretty simple thing for him because I would be working on commission. “Why not, kid? Here’s the desk.” What was funny is that the time I had very little practical experience in the real estate industry. I come from a real estate family, but I’ve never done anything myself. That afternoon I went and I signed up for the state’s Real Estate Licensure course. I took the course over the weekend. The next Tuesday, I took the test and passed it. I came in and handed him my real estate license. He said, “Here you go, kid.” Within weeks, I had closed my first rental.

What it did for me there was I’m reminded of something that a mentor told me years ago. He said, “LV, find the thing that you love doing so much that you do it for free and the money will come.” What I realized then after doing that first rental transaction, I was having so much fun that I had forgotten to get the commission check. You can imagine when I went back in and I handed Bill my big file with everything in it. I said, “Here I am. I’ve completed my first deal,” I had this big smile on my face. I handed him the deal and he starts going through it. He goes, “There’s one problem here, LV. Where’s the check?” He looked up at me and said, “You know this is why we do this.” I looked very surprised. I realized that I completed the entire deal and I’d forgotten to get paid. That was when I realized that this was the thing for me.

As time went on in that job over the summers, I realized that the rental business is a numbers game. You have to see a lot of people, and rent a lot of apartments to make money. Typically, you’re getting about the equal of a month’s rent as your fee, and I had to split that fee with Bill. He gets half and I get half. What I realized was that out of every five people that I would see, one of them would choose to rent an apartment with me. That meant in order for me to make a certain amount of money or to make money doing it, I had to see a lot of people. Most of it was driving people around. This was back in the old days. There was no such thing as Rent.com. You couldn’t do any of that stuff online.

People would find us in the newspaper and they would come to the office. We’d sit down with pieces of paper, fill out people’s names, fill out forms and all that stuff. We drive them all over the city showing them apartment after apartment. I had this crazy idea. There was this thing called the internet that had just popped up. It was like, “You could go in.” It was mostly for fun. We would go and say, “There’s a website here.” That’s what it does. There was America Online. Do you remember America Online? That was how we got on. You put this disk inside of your computer or inside of a slot. The modem would kick on. You’d hear it dialing in and making all kinds of noise. That’s how you got on the internet.

It was so cool and painful.

People were going through this process where they would have to come to the town that they’re moving to. If you know Boston and Cambridge, there are a lot of students. A lot of people would come in and go to school. That was primarily my market. They would fly in. They go get a Boston Globe or a Boston Herald, flipped to the Want Ad section and then go through. They would get the phone number and they call the phone number. You’d see apartment after apartment. You wouldn’t know where you are. You’d have no information about the neighborhoods of the areas or anything like that. You have to learn on the fly.

What I realized is if I take this information and I put it on the internet then people would know. They have more information before they got here. I would be able to introduce myself before they came. When they came, they’d be expecting to see me. They’d have all the information about the apartments that I wanted them to rent. What I understood was that I could increase that 1 out of 5 to maybe 3 out of 5. That was my goal. It was to get more rentals for myself. I had no idea the box that I was opening up. I took that and went out. I got a digital camera. It was a 1 megapixel camera by Kodak. Do you remember that company, Kodak?

They still make stuff. It was a 1 megapixel camera that I got from Staples. Staples was a new company. It was relatively new at that time. I got that camera. I started taking pictures of the apartments and taking the descriptions. I built a website and I put the information up there, and the rest is history. That was RentCambridge.com. That was my first company. I ran that company for a couple of years during college and then after college, the dot-com bust happened. People weren’t investing in it. There were plenty of people that had great ideas that were online. One day they were millionaires, the next day they were poppers. It was a tough time.

Nasdaq from 2000 to the end of 2002 lost 80% of its value.

Those were very tough times. Also, 9/11 happened. That was a thing that happened in between that. That affected a lot, particularly in Boston. I realized that I was not going to be able to carry that business because most of the business was in the summertime. We’d make a lot of money. That first summer or many of those summers, I was making $60,000, $75,000 in four months.

For the audience, Boston has more than 100 universities and colleges in the metropolitan area. Literally, it doubles in size from the point of when it has no students to when the students arrive. Pre-COVID times, the rental market in Boston is a unique market in that respect because it has so many universities.

Find one thing that you love doing so much and willing to offer for free, and the money will come. Share on XMany of my customers were Harvard business school students, Harvard Kennedy schools because there was no housing. Now they have plenty of these big shining towers. They had nowhere to go. You show up and then there would be me, “I’m going to show you to your apartment. Right this way.” That was a pretty tough time. I recognized that it was going to be tough for me to keep that business going because I had to carry it through the winter. I went around looking for a new investment and I found a company. They said, “This is great. We were about to spend millions of dollars to try to build this out. We recognized the opportunity of the internet.” They ended up purchasing my company.

I have to tell you in full disclosure, this was all dumb luck. I was a kid. I had no idea what I was doing. I was winging it the whole time. I found that to be a welcome blessing. It wasn’t the big windfall that I thought would happen but it was the saving grace. What was funny about that and this speaks to negotiation because I didn’t understand what I had. I didn’t understand the value of what I had created. My focus was not on exiting the company. It was saving the company. I didn’t understand the value, the marketplace, the people who I was talking to, and how the market was moving. I was trying to save my bacon.

The company that ended up purchasing it, probably about months after, it was purchased by a much larger national company that owns apartment communities and commercial buildings from coast to coast. The reason why that smaller regional company was purchased was because of the technology and the methodology that I had provided that they had purchased from me. I ended up getting this much, the company that purchased the company ended up getting that much, and then the company that purchased that company ended up getting this much from making money off the technology.

That was my first foray into that. I’ve created, run and exited nine companies since then. Now I run a business development consultancy. I have a transportation company and a consumer electronics company. We work with companies that want to hire us for business development. We work with individuals. We have projects in Rhode Island, Massachusetts and New York. We have other course that we’re about to launch where we’re going to start to work with people who want to take their idea and get those ideas off the ground. We’re going to help them with the business planning, resources, and then also with the funding. Be on the lookout for that.

Congratulations on that.

Thank you.

I went to your website and saw that program. There are a few things that you’ve raised that you’ve mentioned so far that are important to flush out and to talk a little bit more about. You know my background and a lot of the readers do but certainly not everybody. I have a very long history in mergers, acquisitions and divestitures. I worked in corporate development for many years. That was where I cut my teeth in negotiation. It was in that world.

One of the things that I see a lot with small businesses is that they do not plan adequately enough for an exit. The reason why that’s important is because your exit strategy should be informing and influencing every negotiation that you do. It should drive your negotiation strategy. If your objective is to pass your business onto somebody in your family that drives a certain type of behavior, certain types of language, certain types of protections that you want in your relationships. If you’re going to sell, if your objective is to exit through a sale to a larger organization, that drives a certain type of contract strategy, negotiation strategy. If you’re going to go public, that drives something else. You do so much work with businesses and you’ve exited a number of businesses. Talk more about the importance of understanding what your exit is, and how that has informed your negotiation strategies as you’ve gotten more experienced and have seen the correlation more clearly.

That’s a good insight. I’m big on business planning. One of the things that I learned from the Rent Cambridge and Pale Management days is planning is key. That’s one thing that you can control. When you decide to start a business, the first thing that the world hands you is a 90% chance to fail. If you do your job right, if you’re diligent and you go through the planning process, you might be able to reduce that down to about 60%. The best of us is probably about 50%. Planning is key.

When I talk to my clients and deal with mentees and others, the second thing after the planning process that I talk to them about is, “What do you want from this business?” We always talk about what’s the why, but what’s the want is the beginning of the conversation to that exit. You just describe it. If you want to run this business and you want it to be something that’s a legacy that you pass down to your kids or something like that, that’s important to understand. You have to understand what you’re going to do, how are you going to build the company, and set it up so that it will last that long, so it’s sustainable over generations of time. That directly goes into the planning.

Your exit strategy has to be one of those things that you talk and think about in the beginning. Before you do anything, you have to be thinking about your exit. That speaks directly to, “What do you want.” If you want us to make a lot of money and you’re building a technology business that is in the social media space, you’ve got to understand that there are 3 or 4 major players in that space. We’ve seen this in the news. They have a very interesting strategy about how they stay the biggest players. They either by you or they compete against you.

You’ve got to understand that first and that might tell you exactly what your exit is going to be. If you want to make a ton of money, then you know who your customer is before you start your business. You know, “I’m selling this. I’m building this tech play. It’s going to be oriented towards social media. I know that the company I’m selling to is Facebook.” What you can do is you can plan out exactly how you build the business, where are your benchmarks are in terms of where you need to be in terms of revenue. Take a look at what Facebook is buying at the time. Look at what they’re buying, what they’re paying and how that’s going. At what point is that business being positioned for sale? At what point is Facebook looking at that business?

You plan it out. You develop your business plan. You plan out your strategy to get you to that point, and then you present yourself. You put on your tuxedo. You put on your ball gown and you’re ready to go. Looking at exit has to be something you do in the beginning during the planning process. You’ve got to understand who your customer might be, what industry you’re going to be in, and at what point do you want to sell.

45 Attorneys General and the FCC filed antitrust lawsuit against Facebook. They’re looking to break it up and separate out Instagram. They want to carve that out. I’m showing my age. I worked for a Baby Bell. They carved up Ma Bell which was AT&T, and then they created Baby Bell. That’s all changed. It’s very similar. You touched on it without saying exactly these words, but in terms of developing your exit strategy, one of the things that you have to think about is you have to look to the market very broadly in terms of who are all the players. What is the probability of Facebook getting carved up? How does that affect your exit strategy? If your exit strategy is to try to position and sell to Facebook, and Facebook is now in this antitrust garbage, it’s going to be painful for them. It’s going to be painful and expensive even though their stock price didn’t go through the toilet.

Not at all.

It didn’t at all. It was stunning. When you’re thinking about an exit strategy, you got to think not just about, “Don’t put all your eggs in one basket,” but note from a negotiation perspective. For example, in your contracts, especially in the tech space, you have language in the back of the contract, and the general terms and conditions around assignment. Your ability to assign a contract to an acquirer is stated in that clause. If you’re a business who has larger companies, they don’t allow you to assign. Let’s say you’re a tech company who has Verizon. I’ll pick on them because I used to work for them and have negotiated with them a lot. If Verizon has language that doesn’t allow you to assign the contract, if you’re trying to sell to Facebook, that contract relationship that you have with Verizon is one of the reasons why they’re buying you. There’s value in there. You have to pay attention to it. This is why having that view of your exit is so important because it does have a direct impact on how you negotiate your relationships.

When you decide to start a business, the first thing that the world hands you is a 90% chance of failing. Share on XFor me, the most notable exits, when it first came to view the idea that there was such a thing, and this is how I learned over time, it was YouTube. We use it now. We have no thought, but the idea that you could video yourself. Do you remember the camcorders that were like this? You have to put them on your shoulder, the batteries and all that stuff. You’re walking around with these big, huge things. Now we have phones that do that work.

It was a very simple idea. I remember it was a multibillion-dollar acquisition. These were just two kids negotiating out of their dorm room. How did they do that? These are the questions that I asked myself, “What was it that they did? How did they know what to do?” When I entered into the agreement with the company that purchased Rent Cambridge, I had no idea. I was happy that they were even paying attention to me. They could have given me $10,000 and I would have been happy. This would turn out, they offered me more before that, but I did not know what to ask for. I didn’t know what to need and I didn’t negotiate at all. It’s because I didn’t know.

One thing you can do is you should go to a subject matter expert who knows like Christine, and then negotiation. You can understand the value of your company. Valuation is where you have to start. You have to understand, “How do I value this company? At this moment in time, what is this asset worth? How do I get there? Is it the number of contracts? Is it the amount of revenue that I have? What is it that’s going to help me to understand what the value of this is?” I would then say you go to the marketplace and you look at yourself competitively. “Where am I? If I’m selling pizza, how much pizza am I selling? How many pizza stores do I have? What is my market share for pizza? What is my competition? How many slices of pizza do they sell?”

That will also tell you what your valuation is. It tells you how valuable you are to that larger player or even to a smaller player that’s trying to expand. Those are the things that you have to pay attention to, but you’ve got to have the presence of mind to know that those are the things you have to pay attention to. That is where I believe the business planning process begins. It helps you to become not just the subject matter expert of your business, but it helps you to understand how that all fits in with the market and the marketplace that you’re in.

I like that because a lot of times especially for smaller business owners, I see a lot of them and talk to lots of them, they fall in love with their business idea. The word that you used was to look at yourself as an asset. What’s the asset? It implies a level of dispassionate detachment to a certain extent to say, “What’s this asset worth when somebody has blood, sweat and tears during their 401(k), maybe gone through a breakup, and sacrifice everything?” You’re sitting there and they’re saying, “LV, what the hell do you mean? You want me to say my business, my baby is an asset. What are you talking about?” You work with entrepreneurs to help them think through these things. What are some of the things? I always say that the hardest negotiation is the negotiation that happens between our ears. How do you advise your clients in those situations? How do you get them to move from, “This is the baby that I birthed and it took me this long to birth it. This is an asset and this is what is worth?”

That’s tough. With my first business, I was in love with that. For me, it took the market changing in a way that I had no control. It took me facing not having any revenue, not being able to keep the business afloat. I was facing this event where there was nothing that I could do to keep going. Even though I was trying to keep going, everything was shoveling sand against the waves coming. There was no way to keep it going. It took that to jar my mind, to shake me up. What I learned from that is this. The business is you. This is the business. It’s not what you created and how it’s working in the marketplace because you have ideas every day. Entrepreneurs, we’re constantly thinking about different business ideas. I can’t go anywhere and see something or see a problem without thinking about what kind of business I could create with that. You are the business. That’s the first thing that I advise my clients. It’s you who’s the business. The business is here.

For the audience, it’s in your heart, it’s in your head, it’s in the muscle, and the effort that you put into it.

That’s the first thing. I came to the realization that no matter how much I love this business, it’s not going to love me back. It’s simply not going to love me back. It’s going to do what it’s going to do. It’s going to provide what it’s going to provide. I’m the driver of that all the time. You can love your business. You can love the concept. You can love your customers. Your customers might love you back, but if you can’t provide the service or the product that they’re coming to you for, they’re going to go find it somewhere else. It’s tough to do. I think to a certain extent, you have to understand the difference between passion for your business and love that business.

The passion is what drives. The passion is what gets you through. The love is not going to get you there. You have to understand that it’s you that’s the driver. You are the person. You are the entrepreneur. You are the thing that makes it happen. This is just an idea. You’re going to have another idea. If you’re lucky, that idea will be as successful as the first idea. The second is the business is not going to love you back. It will provide for you but you have to feed it, you have to work it, you have to make that a priority, and you have to apply passion, but it’s not going to love you back.

Looking at how one would address especially in a startup, how you navigate moving towards understanding that it’s an asset is going to be predicated on those things. Planning also helps. Understanding that exit strategy, understanding what you’re doing, your mission, how you want to do it, where you want this business to go for yourself. Understanding your what, not just your how, your why, but your what is also something that I would advise clients to do.

I’m reminded of a conversation that I had with an entrepreneur. This young man is brilliant. He’s an engineer by trade. He has a lot of potential there but he was stuck in this idea that presented an opportunity for him to own a business. That business deal was being offered by somebody who was much more experienced. They had been in business for 40 years. This gentleman is in his 70s. That person saw himself giving an opportunity to this young entrepreneur to get into business, but he was still a businessman.

The way that the deal was structured was such that it would be very difficult to maintain. It required a lot of capital to do. This particular entrepreneur was more focused on the opportunity. He loved the idea that he had the opportunity that he wasn’t looking closely at the contracts. He was not looking closely at the deal. When he came to me, he said, “I just need this little bit of money. If I could get $20,000, I can get into this business and I’ll make it work. It’s going to be good.”

We sat down and we took a look. Lo and behold, as we started to go through the contract and we started to look at the deal itself and what he was getting, what we discovered was $20,000 was not nearly enough for this business at all. We also discovered that he was in exit strategy. He was the other guy’s exit strategy. It turned out that what he needed was $2 million. In order to make that business work, he’s going to need $2 million.

There is an order of magnitude difference.

He was seeing the opportunity. The opportunity was in front of him and he was seeing that. He was in love with the opportunity, but he wasn’t looking at the business as an asset. He wasn’t looking at the process that he would have to go through in order to acquire the business, to establish an operational acuity with that particular business, getting to revenue and making the business work over time. He wasn’t focused on that. What we were able to do was we sat him down. We took a look at the contracts and we set up a strategy for him to be able to purchase that business, move through and get that business up and running in partnership with the previous owner by creating a win-win situation for everybody.

He didn’t have the $2 million. There was no way that was going to happen. Given his experience level, it’d be very difficult for him to convince an investor to put up that money without a solid team. We brought together a solid team with differing skillsets that were germane to that particular business. We went to the owner and we said, “We will meet your terms but we need to renegotiate how we’re going to do that.” We set it up so that the owner got the exit that he wanted. The buyer, the young entrepreneur got a solid chance to be able to get that business up and running using the capital that he had available to him.

The business really is you. It's not what you have created and how it's working in the marketplace, but your ideas. Share on XSometimes it helps to have expert’s help as we know, bringing in expert help. That’s something that we do at Cambridge Argillite, and then negotiation. I’m certain that’s something that you could handle easily. It helps to have expert help. It also helps the planning process. Had that entrepreneur sat down and simply wrote out a business plan instead of looking at just the opportunity saying, “What is this opportunity?” Many of those things, they would have discovered along the way. He would have discovered exactly what he should be doing, what the opportunity means, and would help him to frame his emotions instead of him thinking of this as something and falling in love with the opportunity. He would have been able to see it as an asset.

That’s a great story. It illustrates many different things that I see as well when I’m working with small businesses. I love the language that you use around, “Don’t be in love with your business. Your business is not going to love you back.” Not only will it not love you back. Let’s be honest. In many cases, it’s going to chew you up and spit you out sometimes. You just keep standing up and going back at it.

I do a lot of what I affectionately called David and Goliath negotiations and I enjoy those, a lot of technology and lots of big companies, small company things. People get so enamored with, “I’m going to get this marquee account.” That marquee account ends up changing the trajectory of the business in a bad way. It changes their strategy that impacts their ability to get other customers. It adds operating costs. One of the big things that I see that entrepreneurs and small businesses do all the time is always revenue. I’m like, “It should be profit.”

If you enter into a relationship and it’s not profitable, then what the heck are you doing it for? Revenue isn’t enough. You’ve got to make sure. A lot of large companies have requirements in their contracts and their relationships that add cost to small business. They change how you do things from packaging a product, to how you invoice them, to what their payment terms are. How you hire employees can be impacted operationally from some of these relationships. Small businesses don’t think about those things adding costs, and so they don’t recover that cost. It puts them in a negative position.

Along those lines, I’m reminded of another company that I started, Trans Metro Media. We had this crazy idea that we could reposition public transportation payment system assets, the CharlieCards and the CharlieTickets. Particularly in Boston, we call them CharlieCards. Those little cards that you tap as you’re going through the turnstile. We figured we could reposition that. I understood that this business had a huge scale. We had inherent customers. Millions of people take the T all the time, the MBTA here in Boston. We knew that all of those people were going to be our customers instantly by getting this contract and working with the MBTA. I remember understanding that it would scale quickly, and the challenge of what we would need to do to meet that challenge of that scale.

I believe that we had all the plans laid out. I said, “If I could just get some good accounts, if I could go out and get some advertisers, and I can get these folks to buy in and those folks to buy in and win these accounts, then I’ll be good.” I’ll have this piece. I have the revenue. I have the customers. That’s all we need. I remember having a conversation with a woman who I also considered to be a mentor. Her name was Margaret VanGulden. At the time, she’s a marketing executive. I believe she still is. She was a marketing executive for a large telecommunications company in a very large market. I went to her and I said, “Look, I’ve got this golden ticket. Look at this thing. We’ve got inherent customer. We have unlimited growth. Look at what we can do with this. It’s going to be incredible. I want to do business with your company.” She sat me down much like this other entrepreneur. She said, “Why don’t you explain this to me?”

She leaned in and I started explaining. I went through my pitch and she said to me, “This is a great idea. I think it would work but I don’t think we’re the right customer for you.” “What do you mean? You didn’t like my pitch? Was it something I said? Hold on. Let me bring up this spreadsheet. Let me show you the numbers.” She said, “That’s not it. For our business, we’re one of the largest markets in the country. We have ten billion subscribers.” It wasn’t ten billion but it was a lot. I didn’t understand what she was getting at. She quietly said to me, “What would happen if we placed an order with your company today? When could you fulfill that order? Let’s say that we place an order for ten million units. How long would it take you to get me ten million units?” I said, “Wait a minute, I’ve got one right here. Let’s see. If we take a look at the machines that we have, all the other things, and the capacity of those machines.”

What I realized was that by going after that business and winning the account, had she not stopped me, I would have killed the business overnight because we wouldn’t have had the capacity to be able to handle the business that came our way. We would have tried to fulfill the order, it wouldn’t have worked. Not fulfilling the order and having contracts, as you know, there could be landmines in those contracts. That means that we have to give the money back or we owe them the cost of marketing, and all those other things. I wanted to also touch on that. When you’re talking about the business planning process, when you’re thinking about negotiation, and you’re thinking about strategy, you’re looking at the contracts and things like that. Sometimes growing too fast is not what you want to do, and just because you can go out and win that account, it doesn’t mean that’s the account you should have. You will kill your business overnight.

The thing with these big accounts like Verizon, AT&T, British Telecom, any of the major telcos or a Juniper, a Cisco, any of these big companies, they’ll take control of your roadmap. They will drive your strategy. They will force you to move things that you had planned to implement and release a couple of years from now, now. That has implications. If you don’t evaluate that, think about that in your negotiation, protect yourself from that so that you’re protecting the rest of your clients, and you’re protecting the vision that you have for your organization, then they’ll eat you alive. Trust me, their switching cost isn’t that high most times. They can switch. That’s what they do. They’re behemoth, they can switch. I don’t think either of us are saying don’t do business with big companies, but do it carefully. Know exactly what you want out of that relationship, what it’s going to cost you to service that relationship, and how you’re going to manage it because they do. If you don’t and if you haven’t thought about that, then you will get eaten alive.

They’ve got smart people. They have armies of smart people who do that all day. That’s what they think about. That’s what they do. Also, don’t be afraid to ask for help. Don’t be afraid to ask. Don’t be afraid to seek out subject matter experts in your market. Don’t be afraid to contact Christine at Venn Negotiation. Don’t be afraid to contact LV at Cambridge Argillite and ask, “I have this opportunity. What do you think?” That can save you a lot. I’m big on mentorship. I always advise my clients, “Do you have a mentor? Is there someone who you know who has this kind of experience, has gone through this before that you can seek advice from?”

Maybe they may not charge you for it. They want to see you succeed. Seek out those kinds of people. You may not be able to get all of their time, but it’s going to be critical for you in terms of your business development. The one thing that we all get, every single one of us, me, Christine, everyone, when you want to go out and you want to start a business, the first thing that the world hands you is a 90% chance to fail. If you’re really good, you might be able to get that down to 60% or 50%. You need all the help you can get. You don’t have to go it alone.

There are people out there that are willing to help you when it’s critical. You should be prepared to negotiate with those people and pay them. That’s what they do for a living and they’re good at it. You should be looking for those people in your community who have that experience. You should be going to organizations like EforAll that will help you. They help guide you through that process and they give you mentors. That helps you move through the process of getting your business started or even the process of negotiating the marketplace. Look for those subject matter experts and those people who want to see you succeed.

Thank you for saying that. That’s so important. I’d also add, get involved in a good mastermind, where you’re with a group of people and you’re all working to elevate each other’s businesses. The ideas that can come out of it are incredible. For me, my business is moving much faster as a result of mentorship, masterminds, and being involved. Don’t be afraid to pay for that because they will take your business farther faster than if you’re trying to do it all yourself. You might get someplace faster if you do it all yourself, but it won’t be very good. You’re guaranteed to fail if you try to play that game. Building a great team around you and building a great team of mentors and people who are supportive of you and your business is a big thing.

I do want to take a minute because when we talked in our first conversation somebody asked me to describe my client base and I hadn’t thought about it. It wasn’t that I marketed it this way but 100% of my clients are minority women-owned businesses. I sat back and went, “That makes a lot of sense given the work that I do that I’m working to try to level the playing field for people in their negotiation.” There can be this weird or wonky evaluation. There are all sorts of things that are not equal or fair in a lot of ways. I want to try to make things more fair and equitable. I end up working with a lot of minority women-owned businesses.

In our first conversation, you talked about when you see people looking to get investment, that population of people often don’t ask for enough. I’ve seen that. I see that in negotiation. I’ve gotten on this kick because I hear a lot of people talking about gratitude, big names in the speaking industry who claim to be super motivational speakers, yet they use the word gratitude almost as a, “You should be grateful for the scraps that were tossing you off the table, but the rest of it is ours.” That sets up a situation where people become even more afraid of asking. It’s like, “I’m not going to get that account if I ask them to renegotiate. I’m not going to get this if I ask them to do this. I won’t get that raise. People tell me I’m too much. I’m not enough on this.”

You work with a lot of minority-owned businesses. How do you see that part unfolding? How do we help minority women-owned businesses feel empowered to ask for more of what it is they want, not just what they need? Your comment to me was that you see women who need investment, and they don’t even ask for what they need, let alone what they want. When you’re not asking for what you need when you’re going to an investor, you’re not going to get that because the investor knows, because they’ve looked at your business plan that you’re not even asking for enough to give your business a fighting chance to be one of those 10%. Can you talk about that a little bit? I think that’s an important conversation.

No matter how much you love your business, it will not love you back. Share on XOne of the things that I should start is by saying that particularly in the African-American community, we’re going through a very pivotal time, just as pivotal for us in the new millennium as the civil rights movement was for us in the 1960s. We’re realizing that we have the ability to take control of our economic outcomes. We’re realizing the disadvantages that we have. We’re taking action and moving forward. I know that this is something that I’ve said many times that women of color, regardless of what ethnicity that may be, are the future of that movement. They tend to do better in school, have higher academic achievement, have higher positions in companies, and have higher salaries. They’re also the center of the family. They’re the center of the community. At that center, that’s where the economic need is the most acute. You have that natural conglomeration of things that will bring an entrepreneur out of the ether and coalesce into what’s needed for the community.

The first thing that I would say women of color have to know is that they are the future. If they don’t do it, then it might not get done. You can look at that as a responsibility, a challenge, or an opportunity. I tend to look at that as an opportunity because I’m an entrepreneur. That’s the first thing. There are lots of resources and people out there to help. The second thing that we have to understand about that is programming. The programming is subtle. I can go into a diatribe on sociology and how we’re all socialized, but effectively what happens is there’s something that says, “You need a man.” This solution is to couple yourself with someone else.

I’m not saying that’s wrong in all aspects, but what it does is it puts women in a position so that when they’re coming into the business ecosystem, they’re saying, “I’ve got to find that thing that will complete me.” When you go and you’re talking to investors, typically they’re going to be men. Most of the time, they’re going to be white men. The reason for that is because that’s where all the money is. Let’s face it. The rest of us simply have a disadvantage as far as that is concerned. You take that programming, and then you couple that with the visual of everybody who I’m talking to that has the opportunity or has capital is a man, then you get into, “Let me make sure that I’m doing the right thing and I’m showing this person that I’m doing the right thing with their money.” It becomes, “If I go in and I show them I’m not asking for too much, and then I can do this with this much, then great. They’re going to think that I’m being responsible. They’re going to think that I’m being the kind of business owner that they want to invest in. They’ll have more trust and more faith in me and this will be a great relationship.” The beginning of that is programming.

You have to break out of that. I’ve watched over the years women go into negotiations. This is also factual when it comes to negotiating for salary. We’re talking about entrepreneur. We’re negotiating for capital and opportunities. I’ve watched women go into these kinds of negotiations and I’ve watched men go into these kinds of negotiations. Typically, what happens is the women will ask. They’ll go in saying, “If I can prove to them that I can take this little bit and make a lot with it, then that will create the trust that’s needed and we’ll have a good relationship.” Men come in and say, “I’ve got to do this. I want two times more.” They always ask for more than they need. “I’m going to aim high. If I don’t get that, then I’ll back up a little bit. That’s the win for me.” They’re not looking at this as a, “I need to build trust with this person.” They’re looking at this as, “This guy has what I need. This is what I need. I’m the captain of my ship.” That’s the macho point of view.

Looking at it from following this line and understanding that coming in this programming, you’ve got to break through the programming. I’m going to go back to business planning because it’s the business planning that’s going to help you to understand those numbers. It helps you to understand exactly what you need because you’re going to become the subject matter expert in your business. It’s the business plan that will tell you exactly what you need. You’ve got to be prepared to go in and ask for a little bit more. It’s contingency, 20% more. You got to go in and be able to ask for more, but you also have to be self-reflective to understand that you’ve been programmed. You’ve been programmed to work with less. You’ve been programmed to accept less. We’re good at that.

My great grandmother used to say, “We make a way out of no way.” She would talk to me about times when there was nothing. They had nothing to eat. They had flour and molasses. She would tell me these stories that they would eat flour and molasses for days, weeks, and months on end. We’re beyond those days but at the same time, that programming still exists. We tend to make less money doing the same job. We have to make a way out of knowing. We tend to not get the same opportunities in terms of promotions. Those are the things. We tend to be treated differently in a society where we’ve got to navigate a different set of rules. We’re used to making a way out of no way.

You have to be self-reflective and understanding that as you’re moving forward in the business world, you don’t always have to make a no way out of no way, just because this person doesn’t believe in you, there’s another person out there that might. That might not be the right money for you if that makes sense. You got the interview. You were able to get in. You’re sitting in front of the VC or this investor, but that’s not the only investor out there. There are plenty of people out there that do that. I do that. There are many people who invest in other people.

Being an investor, all that means is your job is to take money and make money with money, as oppose to selling pizza or selling TVs. Putting your money out there and it’s the money that’s doing the work. There’s no magic sauce or anything like that. Instead of me going out and using this to work, I’m going to use my dollars. The understanding that you got to understand that there’s programming there, that you have to look past it. You have to recognize that it’s there. As they present themselves, you have to look for those opportunities. You can’t be afraid of those opportunities. Don’t shy away thinking, “That might be a little bit too big. Maybe I need to go back and get an MBA. Maybe I need to go do this.” No way.

Look at the Forbes list. Look at the people at the top of that. Most of the people at the top of that don’t have MBAs at all. They found an opportunity. They found a need and they filled that need. They saw a problem and they solved that problem. That’s what they did. They happened to make it. Is the deck stacked? Yes. There’s a reason. If you look at all of the guys that run the big tech companies, they all look the same. The deck is stacked but it doesn’t mean that you can’t be successful. It doesn’t mean that you can’t place as well. It doesn’t. You’ve got to understand and be self-reflective. You have to have the confidence in yourself. You have to understand your value and your worth. You have to understand the opportunity that you’re being handed.

As a woman, you are the future of the economic outlook for your community. You’re the center of the family. You’re the center of the community, but you’re also the future of the economic outlook. That’s how I approach it. I have a number of mentees and clients that are women of color. What I find when I introduced those ideas, there’s a transformation that occurs. It’s not that you have to go out and become The Devil Wears Prada. You don’t have to be that person, but you do have to understand and know your value. Understand and know that when you’re approaching any situation, you’re as good as everybody else, whether they’re a man, whether they’re of color or not.

You’re as good as everybody else because at the end of the day, it’s the value of the asset. Not just the value of the asset, but the way we keep score is with dollars. When you have those dollars, that’s what the market is saying, you’ve done well. You get it. That’s what matters the most. In the end, whatever shortcoming you may have, if you stick to it and you’re self-reflective, you understand your value, you know the value of your asset, you go through the planning process, you seek help, you look for people like Christine who help in negotiation, you look for LVs in the world, you can do it. There’s nothing that can keep you back. No.

I agree 100%. Thank you for that. I appreciate that. In negotiation, knowing your numbers is one of the most important and most critical things that you can do to be successful at the negotiation table. What you do to help people understand what their vision is, put numbers to that vision, and give them the backdrop and the information that they need to build confidence, because when you have a solid business plan, it immediately builds confidence for you. You know that plan inside and out. You can talk about it. People can throw things out and poke holes in it and you know it. You understand it. That’s a game-changer. How can people find you? How can people get involved in the program? Let the audience know.

Thank you for the opportunity to talk about that because it’s important. I’ve realized at one point that this was my calling, not only being an entrepreneur. That’s who I am. There’s no way that I’m going to be able to separate that from who I am as a person and what I do but I consider it to be my moral obligation to give back and help others, particularly others of color. It’s very important for me to do that. It doesn’t mean that I have to diminish to anybody else to feel that way. It’s important not just to me as a person, to my community at large, to the area that I live in, but also to this country.

As Americans, we have a responsibility if we’ve been afforded good fortune to give back. That doesn’t mean showing up at The Gala, wearing a tuxedo and writing a check. Sometimes you got to go out and you got to talk to people. For me, it’s a moral obligation. You can find more about me at CambridgeArgillite.com, which is my website. We have a Facebook page as well. Social media is there. Thanks to Farhana Cannon who is an amazing digital strategist, has been working with us and taken our business to the next level as you know, Christine. I work as a mentor for an organization called EforAll that focuses on working in communities of color and gateway cities, immigrant communities and communities of color. You can find me there as well. I work as a mentor and I sit on the board of one of the programs going on the South Coast. You can find me there.

If you’re looking to start a business, seek out people like me and Christine. Seek out programs like EforAll because they can help guide you through the process, provide that mentorship, and those initial resources that will get you off to a great start. Are they going to make your business a success? No. That’s going to be up to you. What you’re doing by going to EforAll, what you’re doing by coming to somebody like me, Christine or Farhana is you’re going to be setting yourself up for the best possible outcome. You’re going to be reducing that 90% chance to fail down to 60% or 50%. The rest is going to be up to you.

Thank you so much, LV. I appreciated you being with us. This has been fantastic. I loved it.

Thank you.

To all of our readers, thank you so much for reading. I love doing this show. It’s fun for me. I hope that you guys are learning a lot on it. I can’t wait to see you on the next episode. Until next time, have a great day. Thank you.

Important Links:

- Roxbury Business Development Group

- RentCambridge.com

- Rent.com

- CambridgeArgillite.com

- Facebook – Cambridge Argillite

- EforAll

About LV Randolph

LV is utilizing his 20+ years of experience and skillset for innovation and starting companies to guide other entrepreneurs.

LV is utilizing his 20+ years of experience and skillset for innovation and starting companies to guide other entrepreneurs.

LV’s passion for identifying business opportunities and his lifelong mission of “doing well while doing good” espouses his commitment to the Conscious Capitalist movement.

Cambridge Argillite’s business development division is committed to providing practical and impactful business solutions for early-stage entrepreneurs and small businesses of color, looking to start and scale their operations by providing clients with expert assistance while also funding their capital requirements and providing resources vital to their growth and sustainability.

LV’s business credits include:

Launched in 1996,rentcambridge.com was one of the first online resources where prospective renters could view, select, schedule an appointment and rent apartments online.

Pale Real Estate/Grey Management:

A boutique-style real estate brokerage and asset management firm that specialized in the acquisition, sale and management of multi-family residential property in New York City.

Trans Metro Media:

An innovative approach to repositioning payment system assets for public transportation systems to produce positive growth in non-fare revenue. focused on the branding, re-branding, and licensing of the public transportation payment system assets.

StartupLab Allston:

A Co-Working and Business Cultivation Space for early-stage entrepreneurs.

Specialties:

- Innovation, startup and new business development

- Business and marketing plans

- Negotiating structured buyouts of small companies

- Development and deployment of information technology resources

- Development and deployment of new business strategies